Empowering Your Business Growth with Tailored Capital Solutions

We specialize in providing innovative financing options to help your business thrive. Whether you're a startup or an established enterprise, our diverse programs are designed to meet your unique needs.

Your Finances - Simplified

Working capital is the lifeblood of any business. Healthy cash flow allows you to pursue new opportunities and win more business. It saves you time, gives you greater peace of mind, and the breathing space to make the best long term decisions for your business.

By taking advantage of our funding options, you can free up funds to invest more into your business.

Explore Tailored Funding Solutions for Your Business

Explore services designed to streamline and amplify your business operations.

Line of Credit

Looking for flexible, ongoing access to capital? A revolving business line of credit gives you the freedom to draw funds as needed—similar to a credit card, but typically with higher limits and lower interest rates.

You only pay interest on what you use, can repay anytime without penalties, and reuse the funds repeatedly for growth opportunities, unexpected expenses, or day-to-day operations.

Credit limits up to $500,000

Up To 36 Months Terms

No Collateral Required

6+ Months in Business

Flexible Credit Requirements

Soft Credit Check

Funding in as little as 24 hours

Bank Term Loan/SBA

Business owners can access preferred SBA and bank financing tailored to a wide range of needs—including starting or purchasing a business, ground-up construction, renovations, leasehold improvements, and commercial real estate acquisition or refinancing.

Even if you've been turned down elsewhere, our unique story-based underwriting approach allows us to consider applications that traditional lenders might overlook.

Loan Amounts From $25,000 to $5,000,000

Minimum 650+ Credit Score

Up To 25 Years Terms

Monthly Payments

Up To 100% LTV

No Prepayment Penalty Options

Fast Capital

Get fast, automated small business financing with the personal support you deserve. Our simplified application process gives eligible borrowers access to multiple funding options—all through one easy form.

Use the funds for nearly any business need, including equipment purchases, inventory, working capital, or debt consolidation. Even if you’ve been declined elsewhere due to credit challenges or other obstacles, we may still be able to help.

Loan Amounts From $10,000 to $500,000

No Collateral Required

3+ Months in Business

Flexible Credit Requirements

Soft Credit Check

Funding in as little as 24 hours

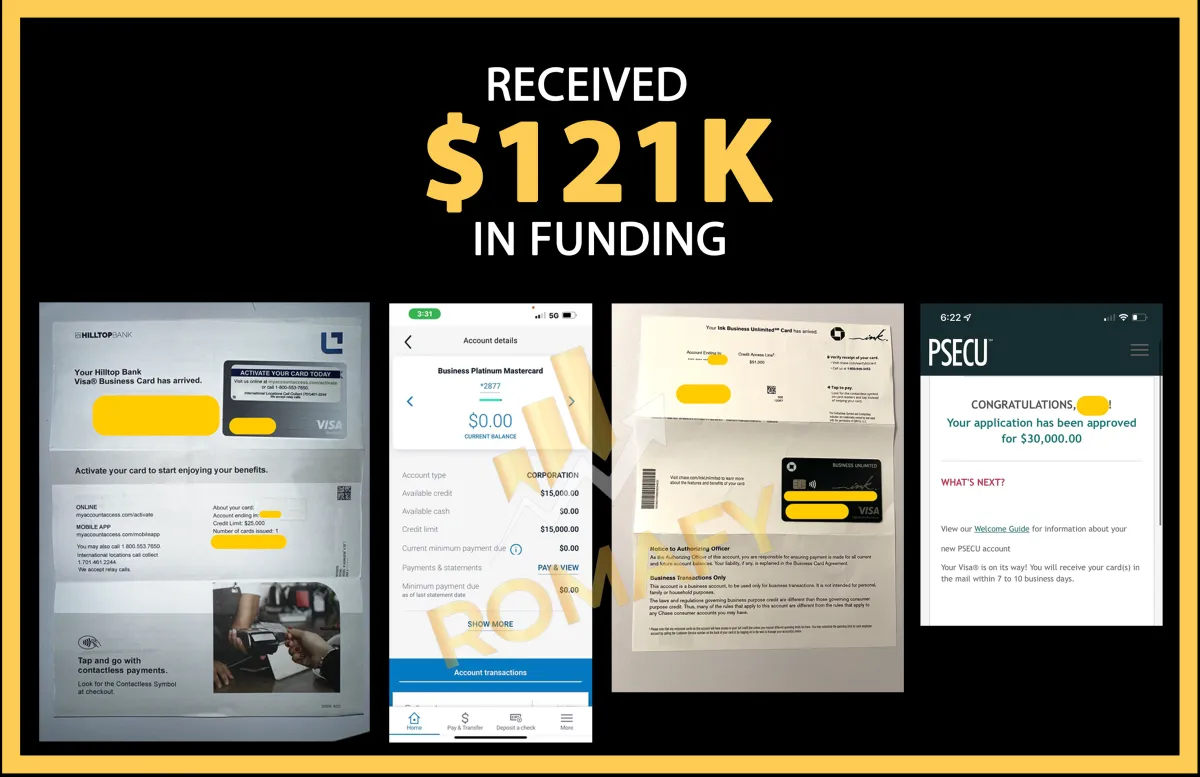

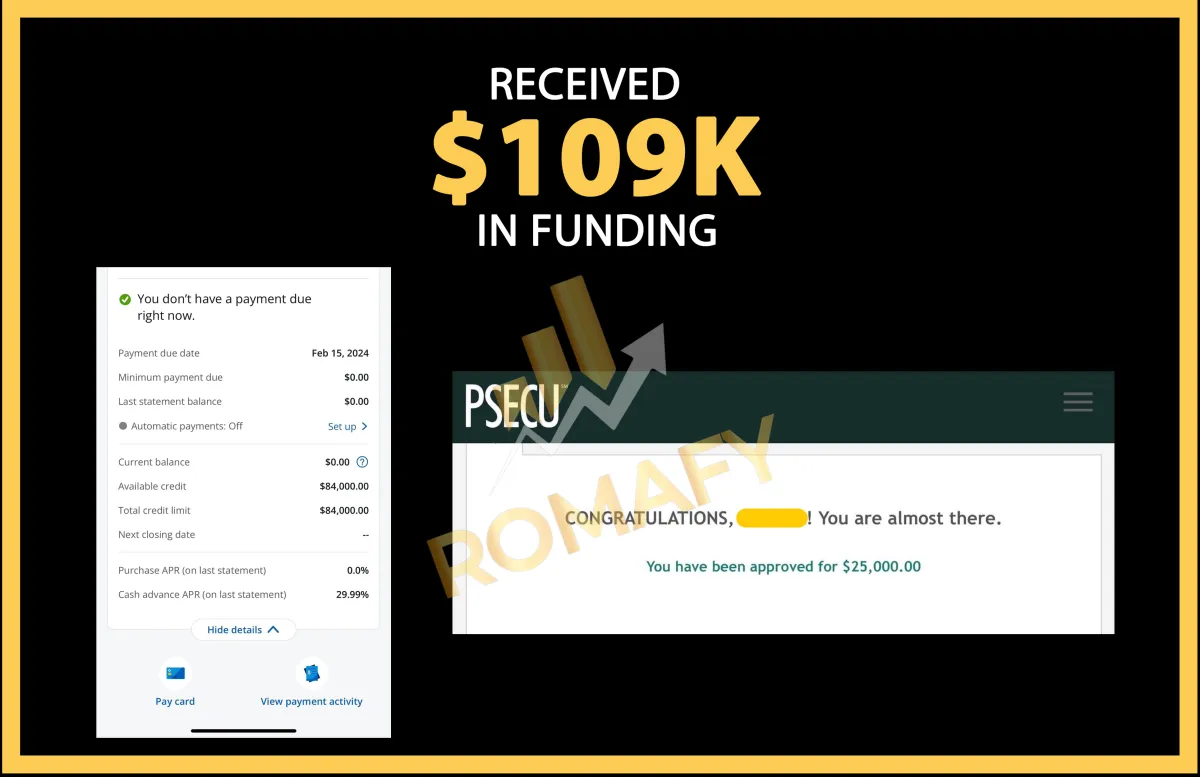

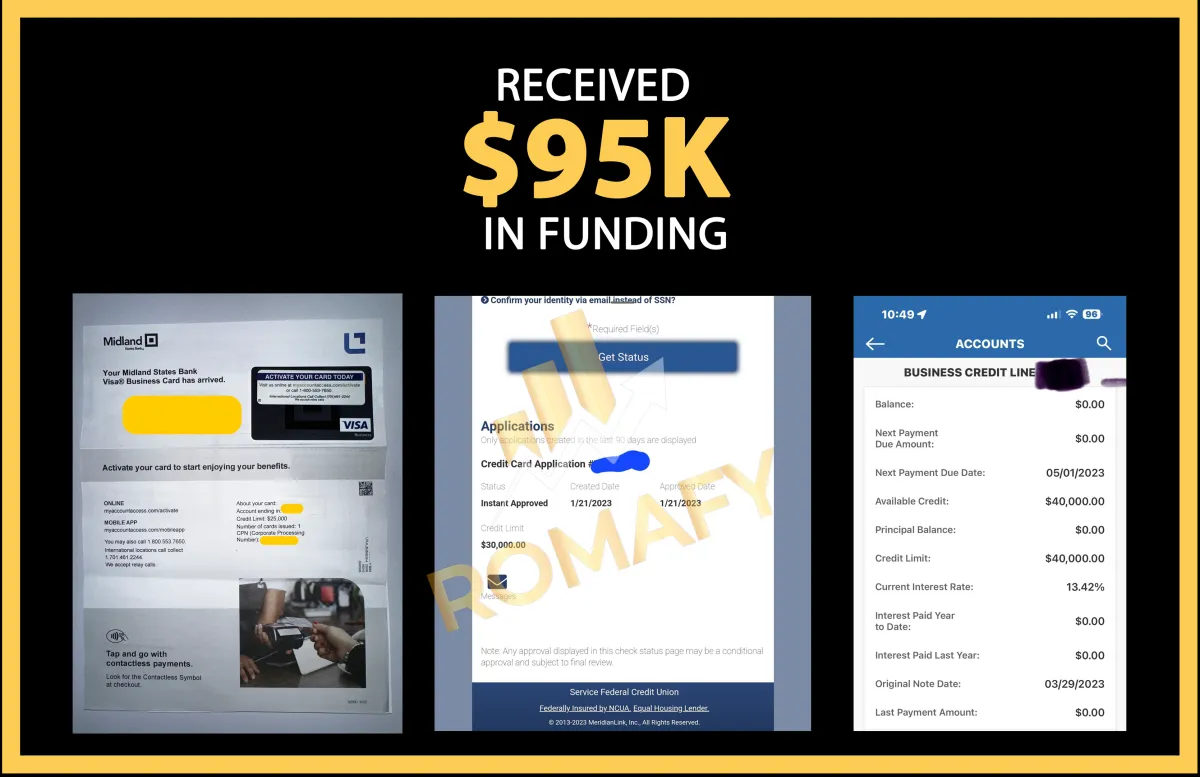

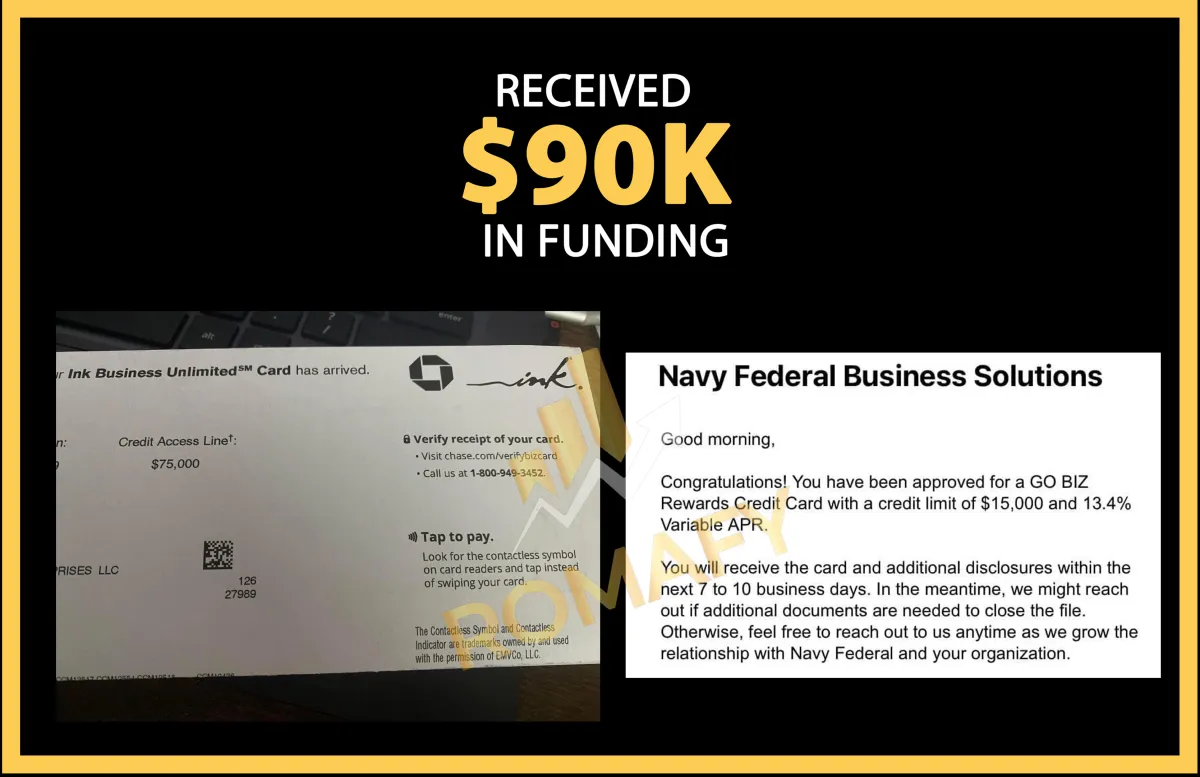

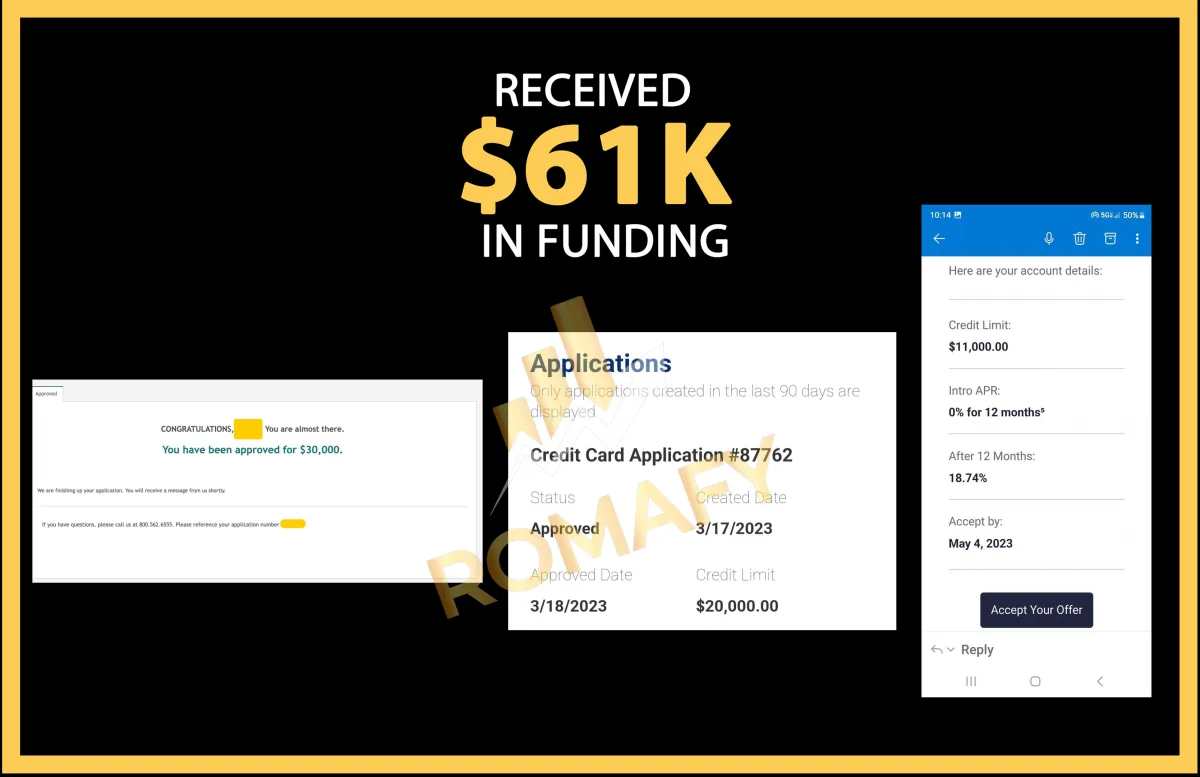

High Limit Credit Cards

Business owners can get access to 0% interest funding through High Limit Business Credit Cards.

$20,000 - $150,000 in Business Funding

0% Interest For 12-18 Months

700+ Credit Score

$5,000+ in Personal Credit Limits

No Negative or Derogatory Accounts

Credit Usage of 30% or Less

Ready to take your business to the next level? Apply now and receive personalized financing options tailored to your needs.

FAQs

Get Quick Answers to Your Business Funding Questions

Does Romafy charge upfront fees?

No. Romafy charges no upfront or application fees. After a borrower signs and accepts a term sheet, he/she will be responsible for the payment of any required due diligence or success fees.

What states does Romafy offer funding options in?

Romafy offers funding options to Business Owners Nationwide. We do not operate overseas

How do I get started?

Just click the "Apply Now" button on this page and complete our simple application. One of our funding specialists will follow up to walk you through your options—no out of pocket expenses, no cost or obligation to get a loan proposal.

What if I have been declined elsewhere?

We specialize in streamline underwriting—which means we go beyond credit scores. Even if you’ve been turned down by traditional lenders, we can often still approve funding options based on the strength of your business and your goals.

What’s the difference between a term loan and an SBA loan?

Business term loans are standard loans with fixed monthly payments and terms. SBA loans are government-backed loans that offer longer terms and lower rates, but have stricter eligibility requirements.

How do business credit cards differ from personal cards?

Business credit cards often come with higher limits, better rewards for business spending, and won’t affect your personal credit if managed properly.